VANCOUVER, BC, Sept. 8, 2021 /CNW/ - NGEX Minerals Ltd. (TSXV: NGEX) ("NGEx Minerals" or the "Company") is pleased to provide an update and review of its Los Helados copper-gold project located in Chile, including new assay results from previously drilled, but unsampled, geotechnical drill holes. These two holes were drilled in 2015 to collect whole-core geotechnical data and were left unsampled. They have now been assayed and will be incorporated into an upcoming resource update. Both holes intersected the high-grade core of the deposit and are infill holes which are expected to result in the conversion of part of the resource from the Indicated to Measured category. PDF Version

Wojtek Wodzicki, President and CEO, commented "These drill holes serve as a timely reminder of the grade and scale of the high-grade core of the Los Helados deposit and the significance of Los Helados as part of an emerging cluster of major copper-gold-silver deposits including Filo del Sol and Josemaria controlled by other entities within the Lundin Group of Companies and the Caserones Deposit controlled by Nippon Caserones Resources, NGEx Minerals' partner at Los Helados. Very few major copper deposits are controlled by junior exploration companies and we believe that the global scarcity of large scale copper development projects and the current strong outlook for copper means that Los Helados will have an important role to play in the development of this exciting new district."

The assays are highlighted by the following:

-

LHDHG02A was mineralized throughout its entire length, returning 1,101m @ 0.70% CuEq (0.52% Cu, 0.28 g/t Au, 1.7 g/t Ag), including a high-grade interval of 224m @ 1.04% CuEq (0.79% Cu, 0.37 g/t Au, 2.7 g/t Ag)

- LHDHG03 was also mineralized throughout its entire length, returning 1,134m @ 0.79% CuEq (0.59% Cu, 0.30 g/t Au, 1.9 g/t Ag), including a high-grade interval of 440m @ 1.03% CuEq (0.82% Cu, 0.31 g/t Au, 2.9 g/t Ag)

|

Hole ID |

From |

To |

Length |

Cu % |

Au g/t |

Ag g/t |

CuEq % |

|

LHDHG02A |

0.0 |

1101.1 |

1101.0 |

0.52 |

0.28 |

1.7 |

0.70 |

|

incl |

460.0 |

964.0 |

504.0 |

0.69 |

0.28 |

2.3 |

0.88 |

|

incl |

460.0 |

684.0 |

224.0 |

0.79 |

0.37 |

2.7 |

1.04 |

|

LHDHG03 |

6.0 |

1140.4 |

1134.0 |

0.59 |

0.30 |

1.9 |

0.79 |

|

incl |

596.0 |

1036.0 |

440.0 |

0.82 |

0.31 |

2.9 |

1.03 |

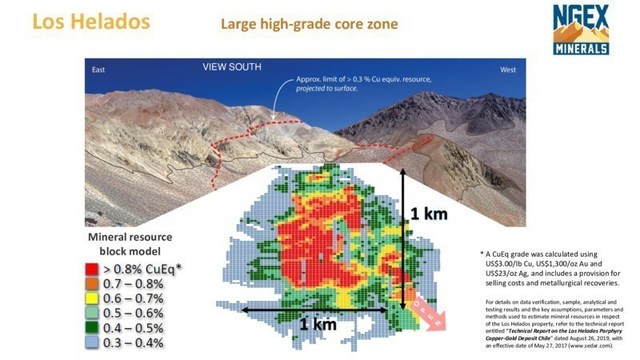

The high-grade intervals noted above intersected a distinct matrix-rich phase of the breccia body that forms the higher grade core of the Los Helados resource (refer to attached figure) This phase was identified during a relogging program completed during 2020. The relogging program was focused on better defining the internal architecture of the Los Helados breccia body, and resulted in an improved geological model which will also be incorporated into the planned resource update.

Previous engineering studies on Los Helados focused on large scale mining of the overall resource. Once the resource update is finalized the Company plans to evaluate the potential to develop a smaller scale mine plan focused on the high-grade core of the deposit which could potentially lead to lower development costs and shorter development timelines.

Los Helados Project Overview

Los Helados is one of the largest undeveloped copper-gold-silver deposits in the world, and it is management's view that that the value of existing deposits, like Los Helados, which are located in favorable mining jurisdictions, should be enhanced as positive market trends accelerate. Other considerations include:

Very large resource base: Los Helados is one of the largest undeveloped copper-gold-silver deposits in the world containing:

- Indicated Resources1 of: 17.6 billion pounds of copper; 10.1 million ounces of gold; 92.5 million ounces of silver.

- Inferred Resources1 of: 5.8 billion pounds of copper; 2.7 million ounces of gold; 35.1 million ounces of silver.

Higher current prices plus a strong outlook: The prices used to originally evaluate Los Helados were US$3.00/lb copper and US$1,300/oz gold. Current spot prices are approximately US$4.20/lb copper and US$1,800/oz gold.

High value clean concentrate: Los Helados would produce a clean gold and silver rich copper concentrate low in impurities. Impurities such as arsenic are a growing problem for smelters, and clean concentrate such as that from Los Helados is expected to be in high demand.

Close to existing mining infrastructure: Los Helados is located approximately 12 km from the Caserones Mine owned by Nippon Caserones Resources, which is NGEx Minerals' 36% partner at Los Helados.

1. Los Helados Mineral Resource Estimate

The Mineral Resource estimate as of the effective date of April 26, 2019 is shown in the tables below:

|

LOS HELADOS INDICATED MINERAL RESOURCE |

||||||||

|

|

|

Resource Grade |

Contained Metal |

|||||

|

Cutoff2 |

Million |

Cu (%) |

Au (g/t) |

Ag (g/t) |

CuEq1 |

Cu |

Au |

Ag |

|

0.58 |

531 |

0.50 |

0.21 |

1.66 |

0.65 |

5.9 |

3.6 |

28.3 |

|

0.50 |

981 |

0.45 |

0.18 |

1.56 |

0.58 |

9.7 |

5.7 |

49.2 |

|

0.44 |

1,395 |

0.42 |

0.16 |

1.52 |

0.54 |

12.9 |

7.2 |

68.2 |

|

0.40 |

1,733 |

0.40 |

0.15 |

1.45 |

0.51 |

15.3 |

8.4 |

80.8 |

|

0.33 |

2,099 |

0.38 |

0.15 |

1.37 |

0.48 |

17.6 |

10.1 |

92.5 |

|

LOS HELADOS INFERRED MINERAL RESOURCE |

||||||||

|

|

|

Resource Grade |

Contained Metal |

|||||

|

Cutoff2 |

Million |

Cu |

Au |

Ag |

CuEq1 |

Cu |

Au |

Ag |

|

0.58 |

There are no Inferred Mineral Resources inside the mining shape at this cutoff. |

|||||||

|

0.50 |

41 |

0.41 |

0.13 |

1.78 |

0.51 |

0.4 |

0.2 |

2.3 |

|

0.44 |

176 |

0.37 |

0.11 |

1.61 |

0.45 |

1.4 |

0.6 |

9.1 |

|

0.40 |

399 |

0.35 |

0.10 |

1.47 |

0.43 |

3.1 |

1.3 |

18.9 |

|

0.33 |

827 |

0.32 |

0.10 |

1.32 |

0.39 |

5.8 |

2.7 |

35.1 |

|

|

||||||||

|

||||||||

ABOUT NGEX MINERALS

NGEx Minerals is a copper and gold exploration company based in Canada with projects in Chile and Argentina. NGEx Minerals holds the large-scale Los Helados copper-gold deposit, located in Chile's Region III, as well as other early-stage projects located in Argentina. NGEx Minerals is the majority partner and operator for the Los Helados Project, subject to a Joint Exploration Agreement with Nippon Caserones Resources Co., Ltd. (formerly, Pan Pacific Copper Co., Ltd.). NGEx Minerals is actively seeking to add to its portfolio of projects as part of its overall growth strategy. The Company is listed on the TSXV under the trading symbol "NGEX".

ADDITIONAL INFORMATION

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

The information contained in this news release was accurate at the time of dissemination but may be superseded by subsequent news release(s). The Company is under no obligation nor does it intend to update or revise the forward-looking information, whether as a result of new information, future events or otherwise.

QP AND TECHNICAL INFORMATION

Technical information in this news release has been reviewed and approved by Bob Carmichael, B.Sc., P.Eng., who is the Qualified Person as defined by NI 43-101. Mr. Carmichael is Vice President, Exploration for the Company.

|

Hole ID |

North UTM |

East UTM |

Elev |

Length |

Azimuth |

Dip |

|

FSDHG02A |

6864800 |

442796 |

4553 |

1,101 |

270 |

-75 |

|

FSDHG03 |

6864700 |

442500 |

4605 |

1,140 |

350 |

-75 |

Both these holes intersect part of a very large breccia body, and both are interpreted to represent the true width of the mineralization at these locations.

Copper Equivalent (CuEq) for drill intersections is calculated based on US$3.00/lb Cu, US$1,500/oz Au and US$18/oz Ag, with metallurgical recoveries of 88% for Cu, 76% for Au and 60% for Ag, based on extensive metallurgical testwork. The formula is: CuEq % = Cu % + (0.6297 * Au g/t) + (0.006 * Ag g/t).

On behalf of NGEx Minerals,

Wojtek Wodzicki,

President and CEO

Cautionary Note Regarding Forward-Looking Statements

Certain statements made and information contained herein in the news release constitutes "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation (collectively, "forward-looking information"). The forward-looking information contained in this news release is based on information available to the Company as of the date of this news release. Except as required under applicable securities legislation, the Company does not intend, and does not assume any obligation, to update this forward-looking information. Generally, this forward-looking information can frequently, but not always, be identified by use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events, conditions or results "will", "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotations thereof. All statements other than statements of historical fact may be forward-looking statements.

Forward-looking statements contained in this news release include statements regarding: the strong outlook for copper prices, expectation that increasing metal prices will increase the value of the Los Helados project, assumptions included in the Los Helados Mineral Resource Estimate, potential demand for Los Helados concentrate, future plans to update mineral resource estimates and mine plans, and potential emergence of Los Helados' general geographic area as an emerging regional district for copper production and the importance of Los Helados therein. Although the Company believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since the Company can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including but not limited to risks related to: Mineral Resources estimates, estimations of costs, and permitting time lines; ability to obtain surface rights and property interests; currency exchange rate fluctuations; requirements for additional capital; changes to government regulation of mining activities; environmental risks; unanticipated reclamation or remediation expenses; title disputes or claims; limitations on insurance coverage; and other risks, uncertainties and other factors identified in the Company's periodic filings with Canadian securities regulators. In addition, these statements involve assumptions made including that the current price of and demand for commodities will be sustained or will improve, that the general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed on reasonable terms and that the Company will not experience any material labour dispute, accident, or failure of plant or equipment. These factors are not, and should not be construed as being, exhaustive.

The forward-looking statements contained in this news release are made as at the date of this news release and the Company does not undertake any obligations to publicly update and/or revise any of the included forward-looking statements, whether as a result of additional information, future events and/or otherwise, except as may be required by applicable securities laws. Forward-looking information is provided for the purpose of providing information about management's current expectations and plans and allowing investors and others to get a better understanding of the Company's operating environment. Although the Company has attempted to identify important factors that would cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. All the forward-looking information contained in this document is qualified by these cautionary statements. Readers are cautioned not to place undue reliance on forward-looking information due to the inherent uncertainty thereof.

Cautionary Note to U.S. Readers

Information concerning the mineral properties of the Company contained in this news release has been prepared in accordance with the requirements of Canadian securities laws, which differ in material respects from the requirements of securities laws of the United States applicable to U.S. companies subject to the reporting and disclosure requirements of the United States Securities and Exchange Commission.

SOURCE NGEx Minerals Ltd.